Well finally I got enough time to re cap material and present an integrated view:

1

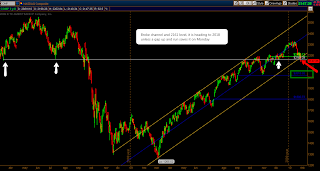

- ES-SPX ANALYSIS : On 10-1 and

17-1 we ere posting these ES charts where you can see the range and the fake breakout that signaled a top and selloff was coming. Technically speaking it was a very weak breakout on no volume and no mkt internals support. We were a bit early when

trying to spot the top (near ES1138) but despite of that, it was clear that the upside move was truncated from the beginning.

2- VIX analysis: Back on 12-26-09 we were anticipating

this probable pattern which should lead to a strong bounce off of 19ish level . On

01-03-10, this update showed one more retest of low levels was to come before a real rally. In fact I got a little disappointed when some daily closes where below the 19 level but now we can see how it was just a typical fake break down (below the triangle's lower bound) just to shake traders out before the real move (up). Anyway if we take a look at monthly candles (original setup was monthly) we can see how the levels were respected.

3- EU indices:

3- EU indices:We were also seeing some bearish setups at EU indices which lead us to think the same moves were about to happen on other stocks markets FTSE100, DAX and Eurostoxx50

anticipated the reversal a bit more clearly:

Also

Greek markets were evidencing clear weakness specially at financial sector (before Obama statements)

Finally

the definition was as evident for every one as previous signs were to anyone non perma bull biased

4-News events: As we said many times, the news themselves are not the cause of market moves. The fact that they coincide in time with moves is that they are used as excuses to trigger moves that were already prepared and "needed" by the market. So all the

Obama and Bernanke issue , are interesting for the econo-political analysis but there is no a cause-effect relation with price itself. Why do we post them here then? Cause we need to be aware there is going to be a move (coincidence in time) when those events happen and trade accordingly. For example, if Bernanke gets confirmed , say on Monday, there is going to be a bounce in markets but is not caused by the news, it is already written in the charts .

5- ST outlook. AT Friday's early session we

were expecting a ST bounce from ES1101 to ES1114-8 area and a close near those levels. In fact it surprised me it was so weak but even less expected was the furious selloff late in the session. It completely blew VIX expected highs and ST tops as well as 1100 SPX level. Given this oversold condition we do expect a new bounce from ES1090 area to ES 1108.75-1111 area (see charts below).

Another foundation for the ST bounce move is the extreme values put/call ratios reached on Friday. As you can see below it touched BB 3 standard deviation. Similar past events are highlighted in green and drove to a ST bounce.

6- LT outlook:

6- LT outlook:The bullish trend is absolutely alive, in fact a pullback to SPX1134 area will be healthy for that trend

7- IT view. - Scenario 1 (most probable)

After a brief bounce to ES 1108.75- 1111 (12-31-08 LOW) I am expecting more downside to test

a) ES 1067 ("Dubai low")

b) ES 1031

- Scenario 2 (less probable)

After a bounce to 1108.75-1111 area, some drop and then a rally into Fed day which continues to retest highs (probably ES1146 gap fill).